By Bryan Tucker posted September 20 2019

(UPDATE: This situation has now changed with the Financial Markets Conduct (Regulated Financial Advice Disclosure) Amendment Regulations 2020. The new regulations came into effect on 15 March 2021 as Covid-19 delayed them. We have left this article here for the sake of history.

Did you know that most insurance advisers aren't required by law to have any qualifications, knowledge or experience? They could have been a carpet layer yesterday and be advising you on your insurance needs today. What's worse, unless they are Authorised Financial Advisers, the law doesn't even require them to place your interests first.

New legislation passed in April 2019 and beginning to take effect from November is set to change that.

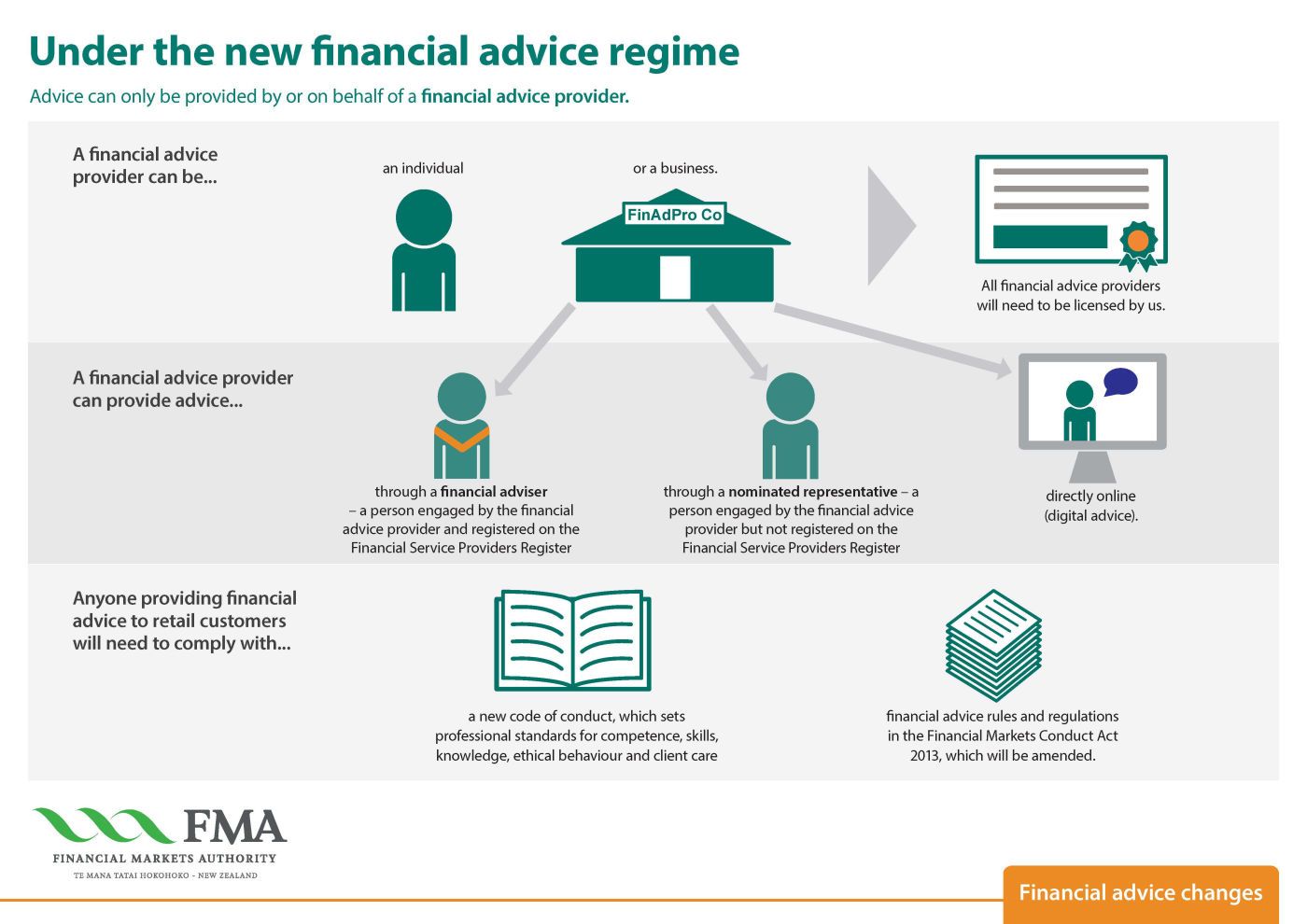

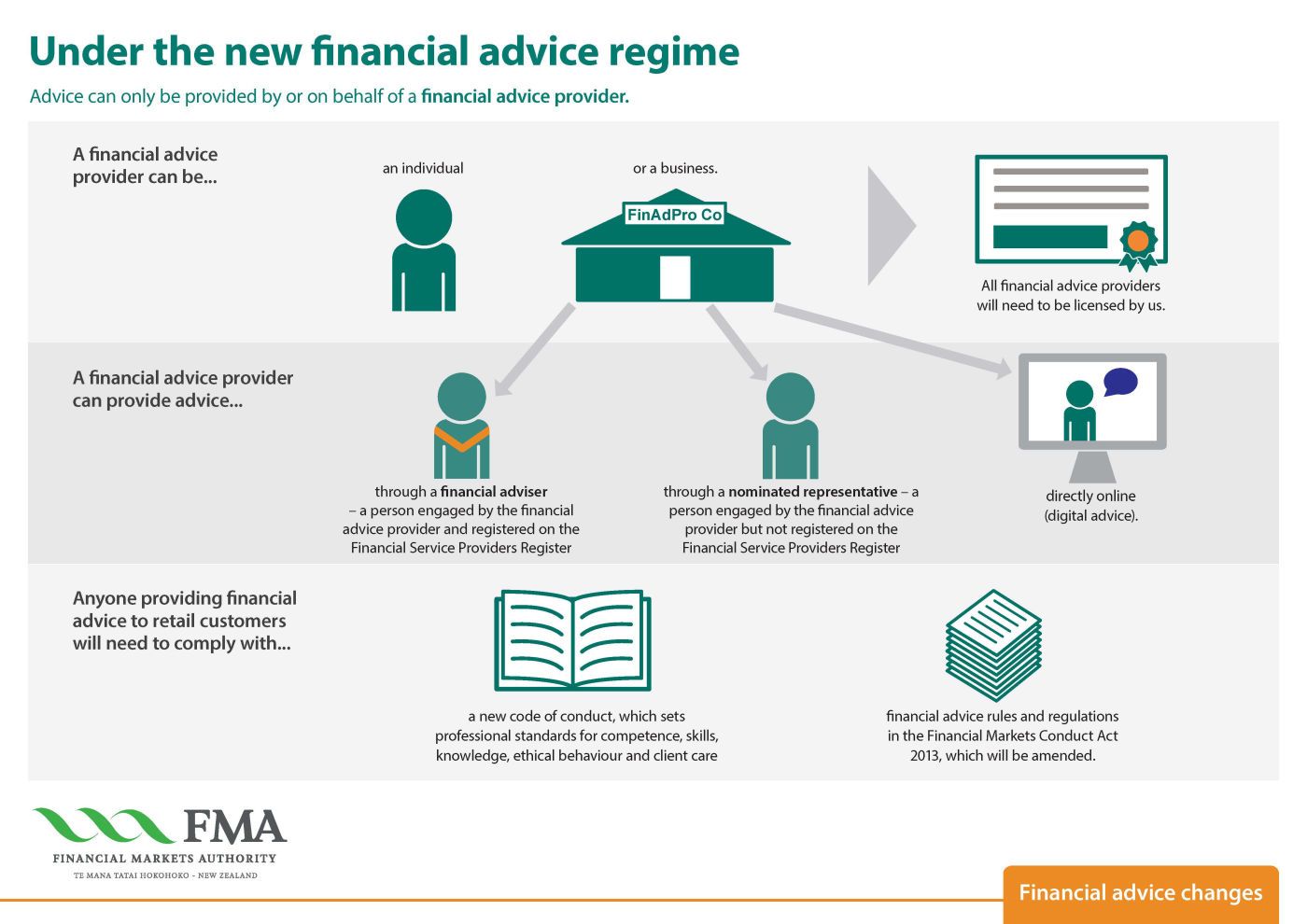

The Financial Services Legislation Amendment Act (2019) removed the three current adviser types – Registered Financial Adviser, Authorised Financial Adviser and QFE adviser and replaced them with Financial Adviser, Nominated Representative and opened up the possibility of RoboAdvice **.

Under the new legislation, all Financial Advisers will need to meet the same conduct and client care standards. Among other things, they must place the client's interest above insurers, their employer or themselves.

The new regime starts to phase in from 4 November 2019 and will be in full effect from June 2020. From that date, Advisers can only advise retail clients if they operate under a financial advice provider licence.

The adviser can hold a licence themselves or work on behalf of someone else who has a licence.

** RoboAdvice - digital advice provided by a computer with no personal interaction

While some background changes will be mainly irrelevant to clients, what will make a difference is that the adviser you obtain advice from will now be required to follow a strict code of conduct requiring him or her to:

- Treat clients fairly

- Act with integrity

- Give suitable advice

- Ensure clients understand the advice

- Protect client information

- Have general competence, knowledge & skill

- Have particular competence & skill about the products they give advice on

- Keep competence, knowledge & skill up to date

While you might have thought that these would be a given, only Authorised Financial Advisers, like those employed by Vesta Cover, have been held to those standards by regulatory bodies in the last 10 years.

So, look forward to a more client-centred experience from your adviser in the future.